We’ve moved to www.bebas-hutang.com

Dear valued reader,

We’ve moved to www.bebas-hutang.com

Please visit above website for latest and more info regarding financial, economy and banking in Malaysia.

Part 2 – Financial Planning with ASB, OD and Card Credit (Perancangan Kewangan dengan ASB, OD dan Kad Kredit)

<Get latest and more info about financial at www.bebas-hutang.com>

First I heard about Aziz CFP was from my friend, who actually heard from one of Aziz’s client. Because the story was not directly from the Aziz’s client, I didn’t get clearly how financial planning with Aziz will improve my financial status. Actually my friend who told me the story also couldn’t clearly understand what it is about.

What he told to me mostly like this. Apply OD (Overdraft), draw cash from Credit Card for your monthly expenses, then put all your salary into OD. The first thing that I was very concerned is about draw cash from Credit Card. By right we should avoid the CC.

Since my friend couldn’t explain much, plus he also didn’t really understand how it works, so I did research from internet. And I found one forum explaining more details. Let me summarize as below.

- Prepare some money in your ASB. Either from your saving or apply personal loan if you don’t have any saving.

- Convert ASB to Sijil, then apply OD with the Sijil.

- Once your OD approved, settle all your major loan.

- Bank in all of your income into OD account.

- Few days after that, withdraw 30~40% of your income’s amount from OD and put into your ASB account.

- Use Card Credit for your monthly expenses and must be within SD (Statement Date) and DD (Due Date).

- Pay amount used by CC on next month use OD.

- Duplicate from step 1 again every month.

Doesn’t make sense huh?…Actually they had explained more details, but I don’t want to share all the story here to avoid you guys get confuse and wrongly manage your financial. Financial planning is not something that you can try and error. Even 1 day will give you a different result.

So I tried to figure out how with my financial status. I did a simulation, via excel, via flowchart, but I still can’t figure out how this can improve my financial. And you have to apply all steps with specific amount and date…depends on your financial status. Finally I started to forget about it and keep all my research and simulation into one folder in my PC…to be continue…

read more at www.bebas-hutang.com

Further signs of rising inflation – be prepare

<Get latest and more info about financial at www.bebas-hutang.com>

BBC NEWS, 14 July…The amount charged by manufacturers for their goods was 10% higher last month than a year ago in a further sign of inflationary pressure in the economy.

June’s rise in producer prices marked a further sharp jump from May’s 9.3% annual rise, official figures showed, reflecting the spiralling cost of fuel.

There is a danger that price increases could be passed onto customers, which would further boost consumer inflation.

Consumer price inflation is already at a 10-year high of 3.3%….more…

Inflation rate in Malaysia just hit 3.8% in May and the highest in 22 months. If we’re looking at other countries, their inflation are rising more higher than us. So be prepare before its too late. Save your money now.

Kadar faedah Kad Kredit rendah jika bayar ikut jadual

<Get latest and more info about financial at www.bebas-hutang.com>

KUALA LUMPUR, 10 Julai (Bernama) — Beberapa bank sedang mempertimbangkan untuk mengenakan caj pembiayaan atau kadar faedah yang lebih rendah daripada 15 peratus setahun sekarang bagi pengguna kad kredit…………..

………Mulai 1 Julai tahun ini, caj pembiayaan ke atas transaksi kad kredit dikurangkan kepada 15 peratus daripada 18 peratus setahun bagi pengguna yang melunaskan baki bulanan dengan segera selama 12 bulan berturut-turut.

Ini adalah mekanisme di bawah struktur harga bertahap yang diperkenalkan oleh BNM pada 26 Jun tahun lepas.

Caj tahap kedua ialah 17 peratus, apabila pengguna membayar tepat masa selama 10 bulan daripada 12 bulan.

Di bawah tahap ketiga, caj 18 peratus dikenakan ke atas pengguna kad kredit yang kerap gagal membuat pembayaran tepat masa.

Gan berkata penjimatan daripada caj pembiayaan itu adalah lebih daripada pembayaran balik tanpa faedah selama 20 hari, yang telah dihapuskan.

“Caj pembiayaan sebanyak 15 peratus itu juga dianggap lebih rendah berbanding pasaran serantau yang mengenakan purata 20 hingga 34 peratus.

“Struktur harga bertahap ini juga diperkenalkan bagi membantu bank menguruskan pinjaman tak berbayar daripada kad kredit,” jelasnya.

Apa faedah kepada pengguna kad kredit? Jawapannya senang sahaja, TAKDE FAEDAH. Tujuan pihak bank adalah supaya mereka boleh collect duit dari korang…dan korang pun akan lebih menggunakannya sebab rasa faedah dah rendah.

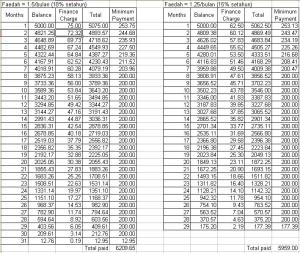

Kat bawah ni aku dh buat kira2 secara kasar beza antara 18% setahun dgn 15% setahun. Katakan korang ada 5k baki hutang dgn kad kredit, pembayaran minumim bulanan adalah 5% dari baki atau minimum RM50. Katakan bila pembayaran minimum korang dh kurang dari RM200, korang tetap bayar RM200. Berapa korang dapat jimat?….dalam masa 2 1/2 tahun, korang hanya jimat RM250. Ini ke yang korang nak?…ciput tu bro.

So kesimpulan, settlekan terus semua dan potong aje kad kredit korang.

Malaysia Will Likely Increase Interest Rates In Q3

<Get latest and more info about financial at www.bebas-hutang.com>

KUALA LUMPUR, July 9 (Bernama) — Malaysia will likely increase interest rates in the third quarter in an effort to curb inflation, having adopted a neutral stance for the whole of 2007, said an economist.

Bank Negara Malaysia’s policy setting meeting is scheduled for later this month. It has kept the overnight policy rate unchanged at 3.5 percent at its last meeting.

Malaysia’s inflation, as measured by the Consumer Price Index (CPI), was at a 22-month high at 3.8 percent year-on-year in May.

A lot of central banks in the Asia-Pacific have or will be raising rates as inflation across the region has soared in recent months and price growth momentum remains strong going into the second half of the year.

Moodys Economy.com’s economist, Sherman Chan, said the food crisis remained a central concern and continued to put upward pressures on prices. She said the fuel price increases implemented by several economies in the last two months would have a notable impact on inflation during the September quarter.

“The Asean economies are facing a similar inflation and monetary policy outlook. For Indonesia, Thailand, Malaysia, Singapore, the Philippines and Vietnam, CPI growth will likely peak in the third quarter and gradually slow in the final months of the year,” she said in a research note.

She said inflation, despite eventually cooling, would remain at uncomfortably high rates. “This will see Indonesia and the Philippines continue with their tightening agenda in coming months.

“Malaysia will likely increase interest rates in the third quarter, having adopted a neutral stance for the whole of 2007. Thailand also looks set to begin its tightening cycle this month,” said Chan. …more…

About CCRIS (Tentang CCRIS)

<Get latest and more info about financial at www.bebas-hutang.com>

CCRIS = Central Credit Reference Information System

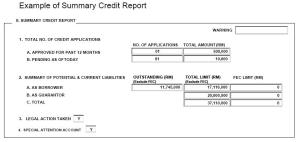

SUMMARY CREDIT REPORT

The Summary Credit Report displays summarised information relating to the

customer’s current and potential liabilities arising from credit facilities obtained

from the financial institutions in Malaysia. The liabilities include those where the

customer has obtained borrowings of its own, liabilities of joint-accounts, sole

proprietorships/partnerships/professional bodies in which the customer is an

Owner/Partner of the business. It also includes liabilities where the customer is a

guarantor for other borrowers.

How to check my CCRIS?

…read more at www.bebas-hutang.com

Part 1 – Experience with MLM

<Get latest and more info about financial at www.bebas-hutang.com>

In Malaysia, everybody knows what MLM is. It stands for Multi Level Marketing. How this business influences Malaysian people?…including me.

Since I first start working in 2003, until before I get married, my salary was just good enough for me. Even I can’t save much, but I still could make some saving. But it changed after I get married. My commitments were become different. There were a lot of things that we need when we are in a family. Then I realized that my current salary is not good enough for us to get better life. So what we did?

I started looking for side income. But I couldn’t do part time job at that time. I was an Engineer at one of Semiconductor Company in Kuala Langat. I always turn back late, even without OT…too bad huh!…but that was my first job…biasala, semangat lebih…haha.

So what we could do to get side income is by doing MLM. No need huge modal, with less than RM100, you can become a member. I joined few MLM…start from Elken, Amway, Network 21, and then Uptrend. The last one was JAI…most people said JAI is not MLM, but now the company’s account has been frozen by Bank Negara and charged illegal. I heard the company has been charged because they doing MLM business without a proper license. So now I considered JAI as MLM too.

What we get after few years with MLM? We lost our time, we lost few k especially with JAI, but we got a good lesson. In fact, none of my uplines in each MLM are really success with MLM after few years. Its not easy as what they keep said to me huh. Now I really 100% don’t believe with MLM or any other business that similar with it.

What I’m doing now? I’m doing financial planning, and hope can share with you guys how I clearing my debts. To be continue…

Financial Education

<Get latest and more info about financial at www.bebas-hutang.com>

There are 3 types of educations.

Scholastic Education

This education teaches us to read, write and do math. It is very important education.

Professional Education

This education teaches you how to work for money. Such as doctors, lawyers, accountants, plumbers, and electricians, automobile mechanics.

Financial Education

This is the education where you learn to have money work for you rather than you work for money. Have you heard a person paid more than RM10k per month, but do not have saving? Doesn’t matter how much you earn every month, but how you can manage your financial, and how much you could save. And this third education is not taught in most schools, colleagues or universities. So where you can have this education? The answer is read a book, get advise from financial planner…or read this blog.

Apakah maksud Kaya

<Get latest and more info about financial at www.bebas-hutang.com>

Sebelum aku berjinak dengan perancang kewanganan, biasanya aku akan panggil orang yang pakai kerata besar, rumah besar itu orang kaya. Atau yang gaji 5 angka dan keatas. Tapi sekarang tidak lagi.

Tak kira berapa gaji seseorang itu, atau apa yang dia ada, samaada kereta besar, rumah besar, tapi kalau mereka juga mempunyai bebanan hutang seperti gadaian, pinjaman kereta atau kad kredit yang tak pernah langsai, mereka adalah sama sahaja seperti yang berpendapatan rendah.

Kekayaan adalah nilai bersih anda. Jika nilai keluar adalah sama atau melebihi nilai masuk, bagaimana anda dapat mengumpulkan kekayaan.

Mungkin anda akan berkata, “saya beli kereta BMW 3 series sebab saya mampu membelinya dengan gaji sekarang”…ok, fine..anda bergaji besar. Tapi anda tetap membayarnya setiap bulan bukan kan? Mungkin selama 7 hingga 9 tahun. Dan dengan pembelian BMW itu, peruntukan untuk simpanan sudah tiada…sama seperti masa anda bergaji kecil dan hanya memakai Proton Wira. Tanpa simpanan, bagaimana anda ingan mengumpulkan kekayaan?

Jadi ingat, kekayaan dinilai dari NILAI BERSIH, bukan pendapatan anda. Millionaire hanya akan dipanggil millionaire jika dia boleh mendatangani cek bernilai 1 million.

2 Jenis Hutang

<Get latest and more info about financial at www.bebas-hutang.com>

2 jenis hutang tu adalah Hutang Tertangung dan Hutang Lapuk.

Hutang Tertanggung:

Hutang yang diambil untuk membiayai aset yang bertambah nilainya, seperti harta tanah dan pendidikan.

Hutang Lapuk:

Hutang yang diambil untuk membeli barang yang tidak akan bertambah nilainya atau yang akan susut nilainya. Ini adalah benda-benda yang dibeli secara sewa beli seperti kereta, peralatan elektrik dan perabot.?

Jadi sekarang cuba imbas, hutang yang mana banyak bagi anda. Apa tunggu lagi…mari kita selesaikan semua Hutang Lapuk…tarak untung!!